As telematics professionals, especially in fleet management or asset tracking, you know how big a choice is regarding GPS trackers. With so many manufacturers and devices on the market, choosing the right ones can be difficult.

To help you select the best GPS trackers for your needs, we have analyzed a year’s worth of data from Navixy platform customers globally and compiled a list of GPS tracker vendors trusted by professionals in the telematics field. If you are a senior professional in technical or sales positions within the telematics industry, this ranking might provide you with valuable information on the suppliers to look at in 2025.

As telematics professionals, especially in fleet management or asset tracking, you know how big a choice is regarding GPS trackers. With so many manufacturers and devices on the market, choosing the right ones can be difficult.

To help you select the best GPS trackers for your needs, we have analyzed a year’s worth of data from Navixy platform customers globally and compiled a list of GPS tracker vendors trusted by professionals in the telematics field. If you are a senior professional in technical or sales positions within the telematics industry, this ranking might provide you with valuable information on the suppliers to look at in 2025.

The 10 most popular GPS tracker manufacturers

Without much ado, let's find out the ten best GPS tracker manufacturers whose products have been integrated with Navixy within the past year and their most popular models. You might want to look at the table below. Compared to the previous years, it has a few changes and one new competitor.

| Rank | Maker | The most demanded GPS devices in 2024 | |

|---|---|---|---|

| 1 | Teltonika | FMB920 · FMC130 · FMB130 · FMB120 · FMC920 | |

| 2 | Jimi IoT (Concox) | OB22 · GT06E · JM-VL03 · GT06N · ET25 | |

| 3 | Suntech | ST4300 · ST410 · ST310U · ST4345 · ST4340LC | |

| 4 | Queclink | GV55W · GV55 · GV300W · GL50B Lite · GV300 | |

| ⬆+2 | 5 | Coban | GPS303F/G · GPS403A/B · GPS306 · GPS103A+/B+ · GPS103 |

| ⬇-1 | 6 | Ruptela | Trace5 · FM ECO4 light · FM ECO4+ · HCV5 · PRO5 |

| ⬇-1 | 7 | Eelink | TK319 · TK119 · TK121 · TK116 · GPT18 |

| 8 | Navtelecom | S-2013 · S-2423 · S-2421 · S-2433 · S-2420 | |

| NEW | 9 | LKGPS | CAT M1 · LK209B · LK720 · LK209A · LK210 |

| 10 | TopFlyTECH | TLW2-12BL · T8803+ · TLP1-SF/SM · TLW2-6BL · TLW2-2BL |

It’s worth noting that Teltonika, Jimi IoT, and Suntech confidently lead the list – nothing has changed there, and we’ll look at them a bit closer further on. However, below the top three, there’s been some commotion.

Coban has made it ahead of Ruptela and Eelink as our customers' preferred choice and secured its place among the leaders. Headquartered in China, Coban has established a robust presence in telematics, offering affordable GPS tracking devices popular in Latin America and Asia. Navixy's LATAM customers prefer Coban for its budget-friendly price points and practical functionality, providing classic fleet monitoring. Over recent months, Navixy has integrated multiple Coban device models, following our partners' requests.

LKGPS, a newcomer in the top 10, is another provider of budget-friendly yet reliable devices. Originating from China, it has quickly become a popular choice for companies that value affordability and straightforward functionality, such as effective real-time tracking, geofencing, and power-saving modes. Customers appreciate its ease of installation and compatibility with popular telematics platforms, making it a logical choice for fleet visibility and asset management in cost-conscious markets.

The most promising contenders to be in the next top 10 list

As for the most promising contenders, the situation has drastically changed from what we previously had, with potential top 10 candidates replaced, significant falls and rises, and several new entries to the list. Let’s take a quick look at the most interesting positions here.

| Rank | Maker | The most demanded GPS devices in 2024 | |

|---|---|---|---|

| NEW | 11 | MyRope | M528 |

| NEW | 12 | Cantrack | G200 · TK06 · TK102 · G900 |

| ⬆+7 | 13 | Auto Leaders | ST-906 · ST-901 · ST-906W · ST-901M · AL-900E |

| ⬇-5 | 14 | CalAmp | LMU-2630 · LMU-800 · LMU-300 · LMU-2720 · LMU-700 |

| ⬇-4 | 15 | Meitrack | T366G · MVT380 · T633L · T333 · MVT340 |

| NEW | 16 | Arusnavi | Arnavi Integral-3 · Arnavi 4 · Arnavi Integral-2 · Arnavi 5 · Arnavi v3 |

| NEW | 17 | GoTop | TK 206 · TK300 · TE-200 |

| NEW | 18 | Jointech | JT701 · GP4000 · JT701D · JT707A · JT301A |

| ⬇-4 | 19 | Galileosky | 7x LTE · v7.0 · v7.0 Lite · 7x · v5.0 |

| ⬇-7 | 20 | Digital Matter | Remora2 · Remora · Yabby3 · Dart2 · Oyster2 |

MyRope, which hasn’t been anywhere near previously, now steps on the top tenners heels, leading the promising contenders' list, hugely thanks to one device you can see in the table above, particularly the M528 model. If you say that MyRope is best known for providing affordable devices, don't be too quick to attribute its popularity solely to this factor. Looking closer at this particular device, you can see that it comes with an external antenna – something more serious and professional vendors offer. Such devices provide higher quality positioning, which is quite a rare feature for affordable devices.

Another newcomer here, Cantrack, is particularly popular in the UK and Europe, with rising demand in North America and the Middle East. Their devices are known for accuracy, real-time tracking, and easy integration with fleet management systems. Recently, Cantrack enhanced their functionality and real-time data insights, including better vehicle diagnostics and advanced reporting, further increasing their value for fleet managers and boosting demand. Looking at their most popular device integrated on Navixy, its distinctive feature is a really capacious battery.

Here, we can see a tendency for companies to look more into GPS tracking devices that combine solid functionality with reasonable pricing, but the price is not the determining factor in making a decision.

The “Big Five”

The Big Five manufacturers—Teltonika, Suntech, Jimi IoT (Concox), Queclink, and Coban—together contribute to 59%—slightly over a half—of all devices added to the Navixy platform in the most recent year. Each of these manufacturers boasts a wide range of devices to cover most vehicle telematics and asset tracking needs. They also provide multiple versions of devices that are compatible with cellular networks in all regions globally, from 2G and 3G/WCDMA, to 4G/LTE, and lower-power LTE-M/NBIoT technologies.

The remaining part of new devices on the platform are attributed to niche players that provide a better fit for specific solutions, or that outperform in terms of affordability, versatility, or innovation. Take, for example, Eelink and TopTen –they are all competitively priced to serve developing markets and basic GPS tracking needs with excellence. ATrack's devices excel at heavy vehicle tracking while providing strong compliance requirements. One more niche player is GalileoSky, whose on-board logic can be easily programmed for highly customizable scenarios.

Many professional customers are developing loyalty to a single supplier

Navixy statistics show that it isn't rare for a single GPS manufacturer to fulfill the needs of some professional GPS solution providers. However, a tendency to diversify the selection of providers persists.

Telematics service providers (TSPs) catering to mass-market segments often look for easy-to-install, cost-effective, yet reliable products. Today, these products might come from a single manufacturer, even if there's a need to track multiple parameters. It's still worth mentioning that while one vendor may be great with vehicle tracking devices, others can offer quality in other areas, such as cargo tracking or non-movable asset monitoring. So, if a business needs to track a combination of movable and non-movable units, they might prefer to extend their number of suppliers. The same is true when a business serves many customers in various regions. They might want to diversify their supply chains for efficiency and avoid delayed shipments due to shortages in electronic components and logistical issues.

System integrators (SIs) cater to enterprise customers with complex telematics solutions. So, they have to deal with many specific requirements, both technical and legal. Sometimes, what worked well for their previous project might not meet the new customer's requirements. This results in the need for higher flexibility when choosing the manufacturer. So, here, we might also observe the tendency to use multiple suppliers to diversify product portfolios and de-risk logistics.

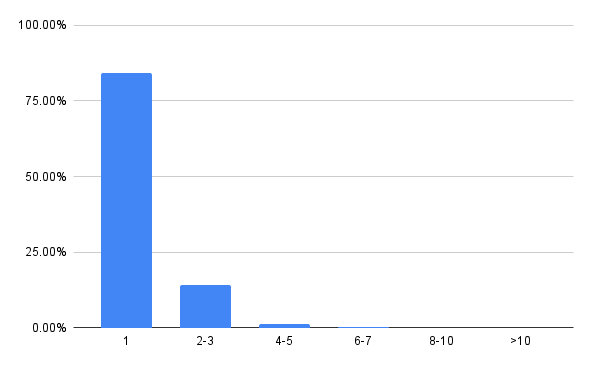

Percentage of providers and integrators by number of manufacturers used

As you can see in the chart above, most GPS service providers and system integrators now work with just one manufacturer (84.29%). A smaller group (14.28%) collaborates with two to three manufacturers, while only a small percentage (1.19%) works with four to five. Fewer providers work with six to seven manufacturers (0.18%), and only a tiny fraction (0.05%) engage with eight to ten.

This picture differs from what we observed in previous years when partnering with two or three manufacturers was more common. It's safe to say that the current trend towards a single provider reflects practical considerations. Leading brands, for example, Teltonika or Suntech, can offer extensive device ranges today capable of meeting diverse customer needs. These manufacturers have also expanded their presence in multiple regions, ensuring faster availability, reduced delivery times, and local maintenance support—factors that make relying on a single partner viable.

Local demands and regional support play a pivotal role in the success of GPS brands

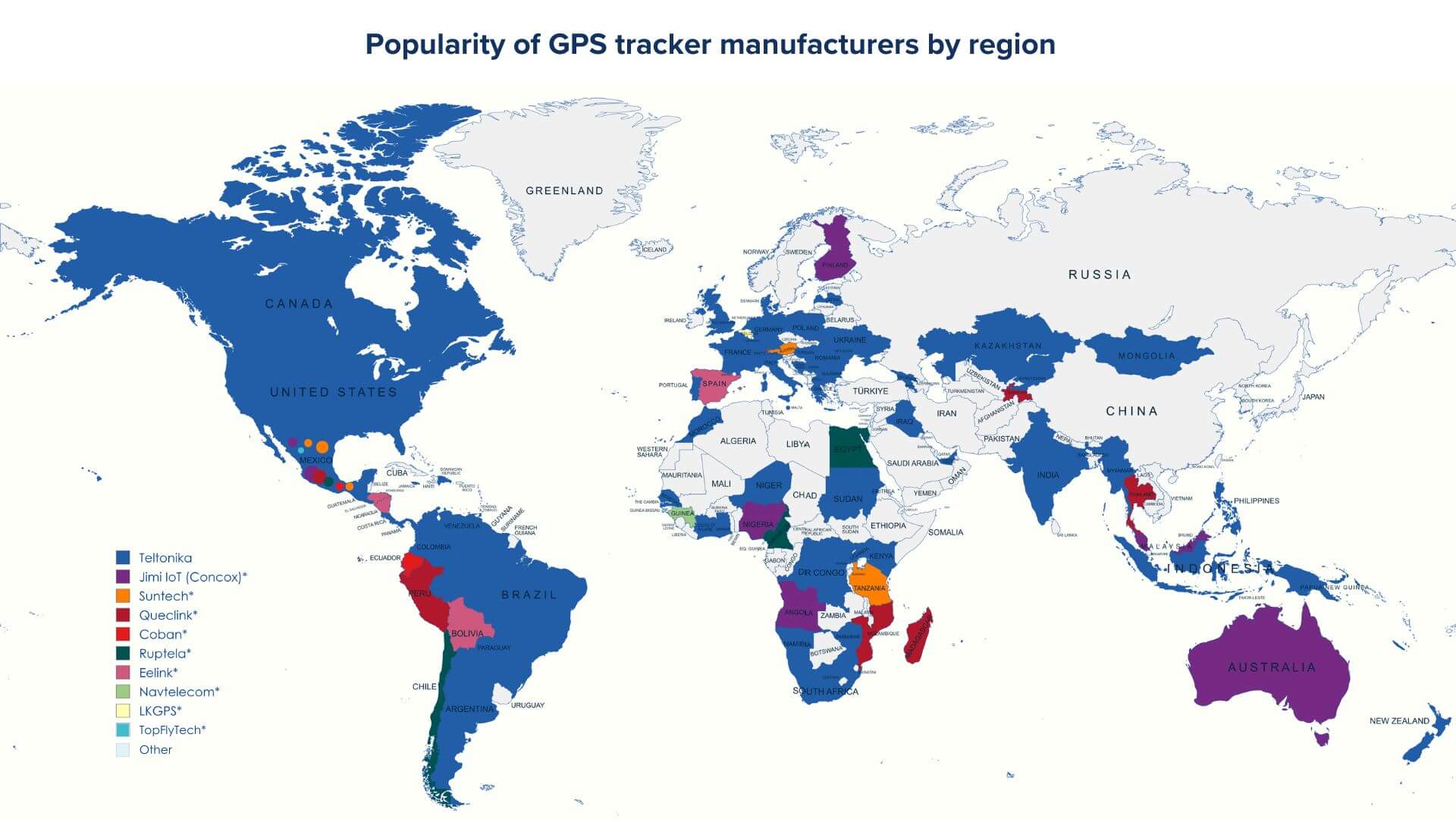

Across the globe, the popularity of GPS tracker manufacturers varies by region. This phenomenon is attributable to two primary elements: how their product line caters to the region's needs and if they prioritize establishing regional branches that are responsible for certification, sales, customer service, and delivery of orders.

To help you identify which brands are the most prominent in your area, we have included a helpful map below.

As you can see, Teltonika's dominance is quite visible. Still, Jimi IoT, Suntech, Queclink, Eelink, and Ruptela are significant players in many regions, especially LATAM.

Most popular GPS trackers by category

Exploring the popularity of GPS trackers in particular categories can be advantageous, as it keeps you informed on technological trends. It also allows you to direct your attention to manufacturers who specialize in creating innovative and cost-effective solutions for specialty markets.

To assist you in gaining valuable insights, here is a list of the market leaders and their respective most popular devices that have been connected to Navixy in recent months.

Navixy expands your choice of GPS hardware for innovative and dependable solutions

GPS technology has a multitude of applications, ranging from automotive and logistics to security and heavy equipoment. In this diverse and competitive marketplace, both solution providers and GPS manufacturers seek mutually beneficial partnerships to prosper in their target niches.

There can be no one-size-fits-all solution, but statistics show important trends to help you build products and solutions that are both innovative and reliable. Whether you're serving mass-market or niche segments, you can be sure that Navixy provides you with the needed flexibility on GPS hardware, seamlessly integrated and efficiently used.