In the US, defaulting on a car loan typically results in a repossession—the asset is collected and reclaimed by a third party contracted by the seller. Typically, borrowers with the poorest credit, also known as subprime borrowers, are the most likely to fall behind on car payments. This means the Buy-Here-Pay-Here dealers that serve these customers assume significant risk, prompting many to install GPS trackers to mitigate the chance that a delinquent borrower evades repossession.

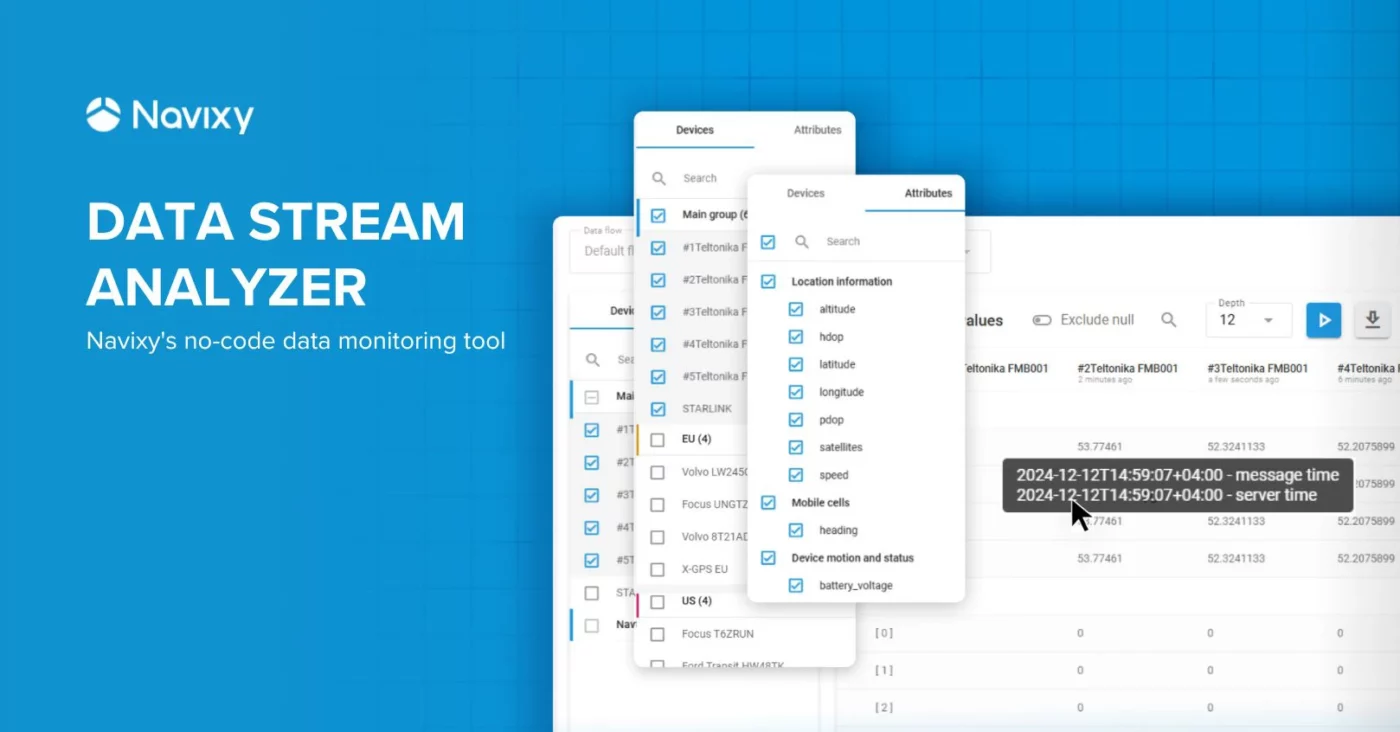

BHPH partners can reliably locate vehicles when customers stop payments with features like live monitoring, vehicle history, geofences, and reports in Navixy. Using our fleet management platform for total asset visibility helps subprime dealerships keep close tabs on all assets and expedite the repossession process to mitigate risk and increase profitability.

Continue reading to learn about Navixy’s GPS tracking solutions for Buy-Here-Pay-Here dealers and how we can help with recovering vehicles when customers default.

Why do Buy-Here-Pay-Here dealers need GPS tracking?

Before the advent of GPS tracking, Buy-Here-Pay-Here car dealerships had to rely on traditional repossession methods—namely, physically searching a delinquent buyer's known home and work addresses. Most give up after about 30 days of searching, meaning approximately 20% of cars in default are never repossessed1. As a result, dealers lose out on revenue in a market that’s already burdened with supply chain delays, shortages, and other challenges.

Though laws vary from state to state, lenders generally have the right to repossess cars when customers don’t pay. Moreover, attempting to hide a car to avoid repossession is illegal in many places, though this doesn’t stop people from going to any length to retain their car.

With the help of GPS tracking devices, lenders can reduce the risk of losing vehicles by easily checking its location when a customer defaults. By helping to expedite the repossession process, dealers can also expect lower repo costs and a higher success rate. With used car values at record-high levels in the US and elsewhere, BHPH dealers hurt even more when they lose vehicles to delinquent borrowers.

Top benefits of GPS tracking for Buy-Here-Pay-Here industry:

- Locate vehicles when borrowers default

- Check vehicle history for recent locations

- Monitor usage with geofences

- Get reports on usage, common locations

- Cut engine remotely

GPS tracking for BHPH: live monitoring, geofences, and more

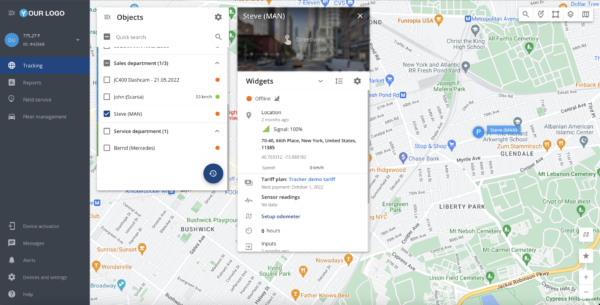

Before contacting a repossession service, you can use Navixy to find out exactly where a given car is. Along with live monitoring on the map, our GPS tracking platform offers vehicle history, geofences, and other sophisticated functions so BHPH dealers have plenty of ways to track their assets.

Live monitoring

When it comes to peace of mind, nothing beats seeing exactly where a vehicle is in real-time. Thanks to Navixy’s intuitive UI, it’s easy to select the asset you wish to view and reveal its position on the map. If the car in question is in default, you can give its exact coordinates to the repo service to significantly expedite the process.

Asset history

To avoid repossession after defaulting on their loan, some borrowers may attempt to destroy or remove the tracker. Fortunately, even if you lose the GPS device’s signal, you can still check its history to see where it’s been most recently. This could be key information that ultimately helps with finding and repossessing the vehicle.

Geofences

Using geofences to keep tabs on mobile assets is an easy way to prevent loss. For instance, if a customer recently stopped paying and you’re concerned about them skipping town, you can set a geofence to alert you if they cross any borders. Or, you can create virtual boundaries around their home and work addresses and set an alert to tell you whenever the vehicle is there. This may also inform you if the customer moves away.

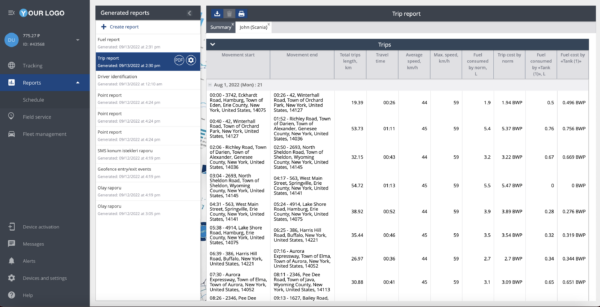

Reports

Another way to find a vehicle is with our reporting function. To determine a car’s most likely location, you can run a report on its last locations over a period of time. Such information can be sent to the repossession agent to make their job easier by giving them more details to track down a vehicle in default.

Engine cut-off relay

In some cases, cutting the engine remotely may be necessary to prevent a person from stealing a car about to be repossessed. By sending a command to the tracker through Navixy, BHPH can disable the vehicle to ensure it stays put until the repo agent can retrieve it.

Best GPS trackers for BHPH

Navixy supports a number of devices suitable for BHPH industry, meaning Buy-Here-Pay-Here dealerships can expect a wide range of options. Common types of GPS trackers include portable, OBD, and hardwired, which we’ll discuss in more detail below.

Portable: These small, easy-to-hide trackers are ideal for BHPH partners since they can be secured practically anywhere to avoid potential removal or destruction. Despite their size, these devices have long battery life and offer precise tracking to ensure you always find a vehicle. Not to mention, they’re cost-effective and easy to install.

Hardwired: To further prevent the unlawful removal of a GPS tracker, you can install devices that are hardwired directly into the vehicle’s electrical system for power. Hardwired trackers generally require professional installation, so keep this in mind when considering your needs.

OBDII: Though GPS trackers that plug directly into the vehicle’s diagnostic port are simple, convenient, and inexpensive, they’re also quite vulnerable and easy to remove. For this reason, they’re not recommended for BHPH partners.

BLE beacons: For heightened security, consider using BLE beacons to activate a secondary tracker. This prevents loss of signal in the event that a customer finds and removes the primary tracking unit.

For additional details about specific devices that are suited for BHPH, be sure to contact us. We have many top-rated GPS tracking devices from trusted brands like Teltonika, CalAmp, Queclink, Suntech, TOPFLYtech, and others.

When a customer stops payment, you can trust Navixy to help find exactly where the vehicle is. Our GPS tracking solutions ensure total visibility for reliable monitoring and a simplified repossession process. With the help of our modern tools, Buy-Here-Pay-Here partners can expect fewer asset losses, reduced repo fees, and more timely payments from customers.

You can learn more about our white-label, fleet management platform by contacting a sales representative today at sales@navixy.com.

- https://www.coxautoinc.com/market-insights/auto-loan-defaults-are-increasing-but-we-are-not-heading-into-a-repo-crisis/#:~:text=Cox%20Automotive%20estimates%20that%20the,and%201.7%20million%20in%202019